Series: Credit Elevated: Five Power Moves to Shatter Debt & Raise Scores

(Missed Post #2 on removing late payments fast? Catch it here.)

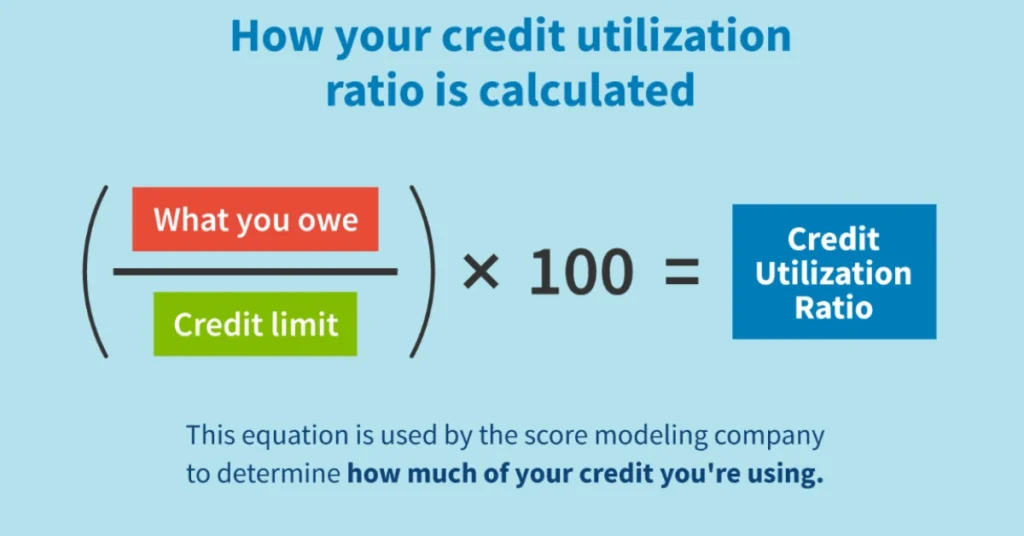

You’ve cleared old data (Post #1) and tackled late payments (Post #2). Now, we dive into credit utilization—often the second-most significant factor affecting your score. Heard the advice “Keep it under 30%”? Good baseline, sure—but if you truly want to reduce credit utilization fast, single-digit usage (1–9%) is where the magic happens. Let’s dissect why.

The Utilization Factor: 165 Potential Points

Credit utilization represents roughly 30% of your FICO score—about 165 points above the baseline. People often settle for “under 30% usage” because it avoids severe penalties. But if your real goal is a score boost, you’re leaving 40–60 points on the table by not aiming for single-digit usage.

Quick Recap:

💎 Aggregate vs. Individual Card Usage: Lenders look at both your overall utilization and each card’s individual balance. If just one card is at 70%, that drags your score down—even if others are at 5%.

💎 Below 10%: Repeatedly proven to yield bigger point gains—that’s how to reduce credit utilization fast.

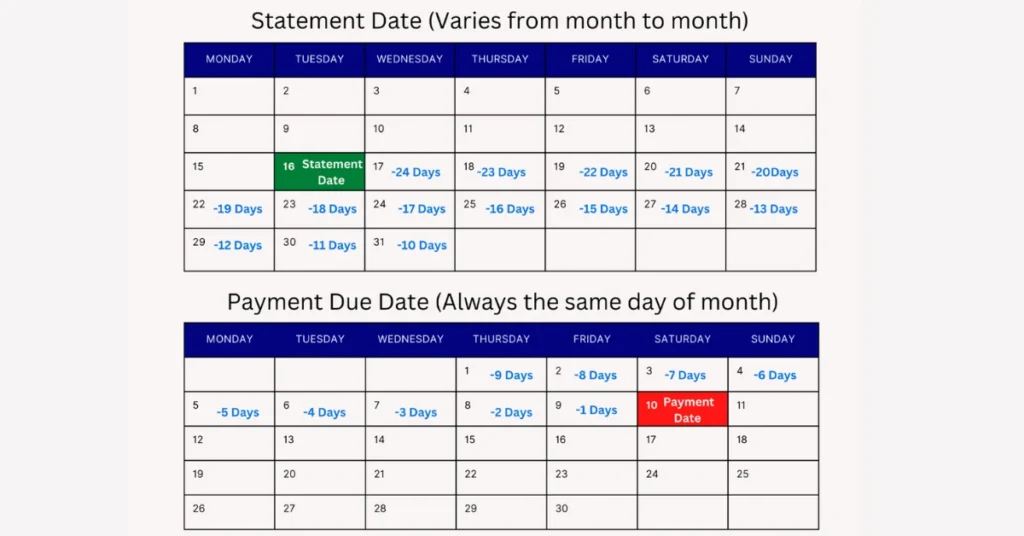

Statement Date vs. Due Date: The Real Reporting

Most folks confuse the due date with the day their balance is reported. And that’s not true at all. Understanding this simple fact is a game-changer. Let’s break it down.

💎 Statement Date: When your monthly statement closes—that is what the bureaus see. If your balance is 40% on the statement date, you’re reported at 40%.

💎 Due Date: When the payment is officially due to avoid late fees and interest charges.

Why It Matters:

- Paying down your card after the statement date but before the due date doesn’t help your official utilization because the credit bureaus already saw the higher balance.

- Action: Schedule a payment or two before the statement date, ensuring your balance is under 10% when that date hits.

Example: If your statement date is the 15th, aim to pay enough on the 12th or 13th so your statement prints a low balance. That’s the sweet spot to reduce credit utilization fast.

Why 30% Is a Myth

You see “Keep it under 30%” everywhere. That’s just baseline advice to avoid penalty territory. But you’re after a real credit score push. Here’s the real breakdown:

- 1–9%: Prime bracket. Lenders see you as disciplined, not reliant on credit. Expect bigger gains.

- 10–28%: Decent, but not unlocking your full potential.

- 29–48%: Approaching riskier territory—your score dips more here.

- 49%+: Danger zone—often viewed as “maxed out.”

If you’re sitting at 30% usage and thinking you’re good, you could snag an extra 30–60 points by nudging into single digits. That’s a serious payoff, especially if you’re near a threshold for better interest rates.

How to Reduce Credit Utilization Fast: Concrete Steps

- Pay Before the Statement Date

- Tip: Mark your statement date (not just your due date). Pay enough to drop your balance below 10% by that day.

- Request Higher Credit Limits

- Tip: Soft-pull limit increases (from banks like American Express, Discover) can be done every 3–6 months. Higher limits + same spending = instantly lower usage.

- Spread Balances

- Tip: If one card’s at 70%, consider shifting some balance to another card. But watch out for multiple due dates if you’re prone to forgetting payments.

- Balance Transfers or Consolidation

- Tip: Moving high-interest debt to a low-interest or 0% promo card can drop your usage on old cards. Don’t max out the new line, though—spread it wisely.

- Track Autopay & Alerts

- If you’re worried about juggling multiple cards, a tool like creditelevated.pro can ping you before the statement date. That way, you always know when to pay down to single digits.

Tie It Back to the Series

This is Post #3 in your Credit Elevated series. Last time, you learned how to remove late payments in Post #2—huge for boosting your score. Now you see why staying below 10% utilization is crucial to reduce credit utilization fast.

📌 Up Next: Post #4— Remove Charge-Offs Fast—Disputes, Ownership & Clearing the Deck

.” We’ll tackle serious negatives like charge-offs and advanced disputing strategies for those bigger blemishes.

(Missed the scoop on late payments? Click here to read Post #2.)

Next Steps

- Identify Your Statement Dates: This is your official usage snapshot—plan your payments around it.

- Aim for Single Digits: 30% is okay, but not if you want the real point gain.

- Request Limit Increases: Every 3–6 months if it’s a soft pull.

- Monitor & Repeat: Keep your usage below 10%, and watch your credit score climb significantly.

Whether you handle everything manually or let automation help, the difference comes from understanding how the bureaus see your balances. Don’t leave 30–60 points on the table with that 30% myth. Reduce credit utilization fast—and keep building a bulletproof credit profile.

📌 You cannot miss Post #4, where we wrestle down charge-offs and advanced disputes, clearing the deck for even bigger score jumps.

Leave a Reply