Your credit score isn’t magic—it’s math, and you can hack it with the right tools.

Let’s turn confusion into clarity and unlock the doors to financial freedom.

Let’s be real—credit scores can feel like an untouchable mystery. You hear about them everywhere, yet the system seems rigged against you. But here’s the good news: credit score mastery isn’t about luck; it’s about strategy. This guide breaks it down, giving you the tools you need to take charge of your credit, open doors to funding, and level up your financial life.

What Is Credit Score Mastery?

Think of your credit score as a financial report card. It’s a snapshot of how you manage debt, payments, and credit behavior. Mastery begins when you understand the components that make up your score and use them to your advantage.

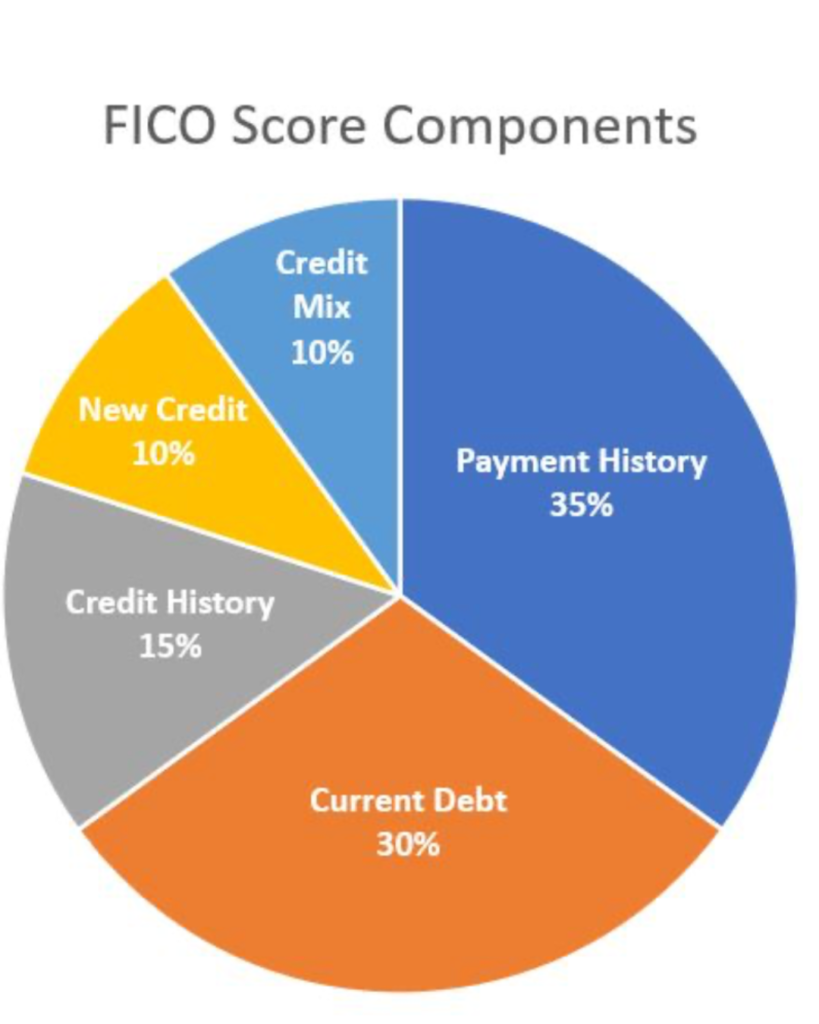

Breaking Down the Components

Your score is calculated using five key factors:

- Payment History (35%): Paying bills on time is the foundation of a great score.

- Credit Utilization (30%): Using less than 30% of your available credit is ideal; under 10% is even better.

- Length of Credit History (15%): The longer your accounts have been open, the better.

- Credit Mix (10%): A mix of credit types (credit cards, loans) adds diversity to your profile.

- New Credit Inquiries (10%): Too many hard inquiries can ding your score temporarily.

Pro Tip: Think of credit utilization like packing a suitcase. If it’s crammed full, it’s inefficient. Leave room, and you’re ready for emergencies without overextending yourself. This is the first steps in understanding credit score mastery.

Debunking Credit Myths

Misconceptions about credit are everywhere. Let’s clear them up:

- “Checking my credit hurts it.”

Truth: Only hard inquiries (like applying for a loan) affect your score. Soft inquiries, like checking your own score, don’t. - “I should close old credit cards I don’t use.”

Truth: Closing cards can shorten your credit history and increase utilization, both of which lower your score.

Pro Tip: Instead of closing unused cards, set up a small recurring charge, like Netflix, to keep the account active.

Building Credit the Right Way

Improving your credit isn’t an overnight process, but small, consistent actions add up.

Payment Consistency is King:

- Always pay bills on time, even if it’s just the minimum.

- Tool Tip: Set up auto-pay or calendar reminders.

Master Your Utilization:

- Aim to keep usage below 30%; under 10% is even better.

- Hack: Pay down balances before the statement date, not just the due date.

Boost Your Profile with Piggybacking:

- Ask a trusted family member to add you as an authorized user to their card. Their good history boosts your profile.

The Path to Funding: From Credit Score Mastery to Approval

Once you’ve built a strong credit profile, it’s time to strategically secure funding. Here’s how to do it:

The Horizontal Stacking Method

Horizontal stacking isn’t just about applying for multiple financial products quickly—it’s about navigating the credit system with precision.

- How It Works:

The three major credit bureaus—TransUnion, Equifax, and Experian—don’t immediately share data. Most lenders report to just one bureau, meaning you can strategically apply across bureaus to secure funding while keeping your inquiries low. - Step-by-Step Guide:

- Apply with a lender that reports exclusively to Experian.

- Immediately move to another lender reporting only to TransUnion.

- Finally, apply to a lender that reports to Equifax.

- Why Timing Matters:

Completing this process within 72 hours minimizes reporting overlap, ensuring each bureau sees only the inquiries made through their respective systems. - The Result:

By limiting inquiries and diversifying your applications, you maximize approval chances without raising red flags.

Understand Funding Tiers

Not all credit is created equal. Here’s what you can expect based on your score:

- Tier 1 (Excellent Credit): Access to 0% APR cards and high-limit loans.

- Tier 2 (Good Credit): Moderate business lines of credit and personal loans.

- Tier 3 (Fair Credit): Secured cards and credit-builder loans.

Avoid Funding Pitfalls

- Use pre-qualification tools to assess eligibility without hard inquiries.

- Focus on quality applications over quantity—this reduces unnecessary denials and inquiries.

Pro Tip: Funding success hinges on preparation. Master the Horizontal Stacking Method, and you’re miles ahead of the average borrower.

Elevate Your Credit with Credit Elevated

Your credit journey doesn’t stop at improvement—it’s about empowerment. With Credit Elevated, you gain access to:

- Comprehensive Tools: The same software top credit repair companies use—free for you.

- Affordable Monitoring: Protect your credit with monitoring services starting at $29/month, or $39/month for added identity protection.

- Zero Hidden Fees: Your credit repair is 100% free until every negative item is removed from your report.

Why We Offer This: At Skyline Pivot, we believe in helping you build a strong financial foundation without putting you in debt to get there.

👉 Fix Your Credit Now with Credit Elevated

Final Thoughts: Turning Knowledge into Action

Your credit score isn’t a wall—it’s a door waiting to be unlocked. By understanding the system and implementing strategies like Horizontal Stacking and funding tiers, you’re setting yourself up for success.

Knowledge is power, but action is key. Ready to level up? Let’s start your journey to credit score mastery and financial freedom today.

Related Links:

Leave a Reply