They say the rich get richer—and it’s not just because of hard work. The secret weapon? Building wealth with tax strategies.

Taxes are inevitable, but they don’t have to be a burden. With the right mindset and strategies, they can become a tool for financial growth. And no, you don’t need millions to play this game. You need awareness, intention, and a willingness to think beyond the paycheck deduction.

This tax season, let’s pull back the curtain on how the wealthy navigate taxes and how you can start doing the same. We’ll teach you the tricks of the trade, keep it real, and leave you empowered for the journey ahead.

The Wealthy Don’t Just Work Hard—They Work Smart

For most of us, taxes are just something we pay. For the wealthy, taxes are a game they play—strategically. Here’s what they do differently:

Borrowing Against Assets

Instead of selling stocks and triggering capital gains taxes, the wealthy borrow against their assets. For example, if you own $100,000 in Amazon stock, you can borrow $50,000 tax-free. Your stock keeps growing while you get access to cash. This move keeps the wealthy liquid without handing Uncle Sam a big cut.

Moving to Tax-Friendly States

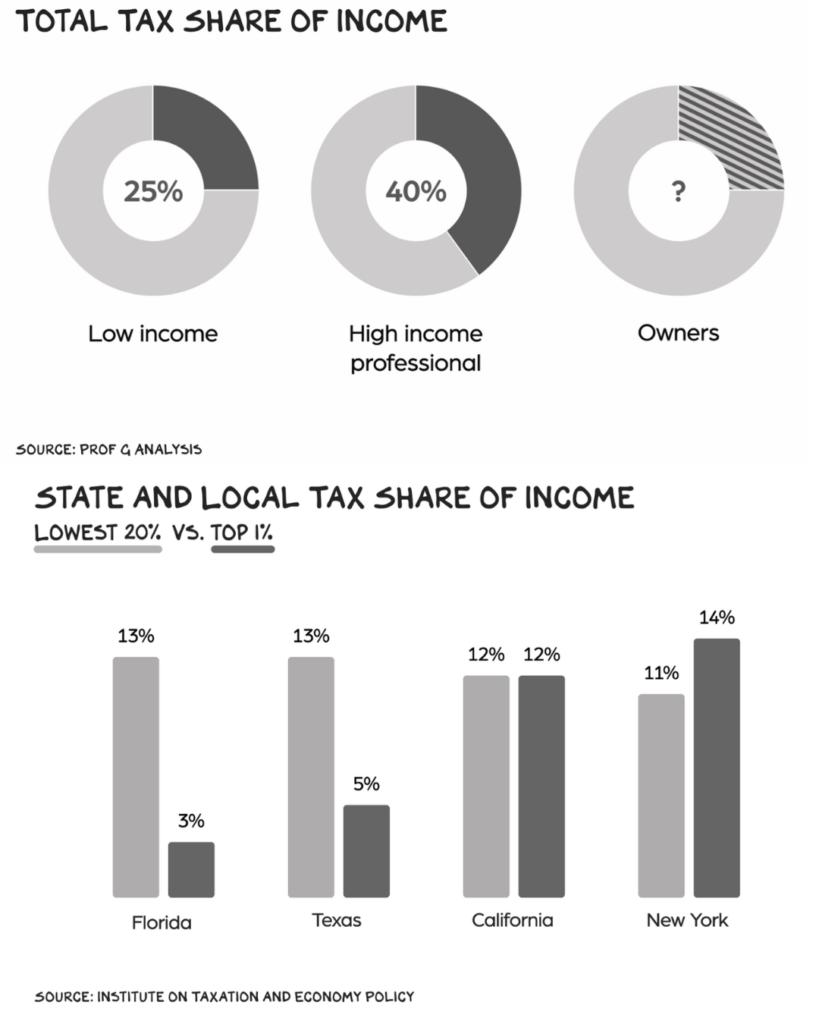

Notice how billionaires suddenly “love” Florida or Texas? It’s no coincidence. These states have no income tax, saving them millions compared to high-tax states like New York or California. It’s a strategy, not sentiment.

Qualified Small Business Exemptions

Here’s one for the small business owners: The Qualified Small Business Stock (QSBS) exemption lets owners of businesses valued under $50 million sell the first $10 million of their stock tax-free after holding it for five years. Yes, you read that right—zero taxes. The tax code rewards business builders.

Why You Need to Think Like a Tax Strategist

The tax game isn’t just for billionaires. You can start applying these strategies to your financial life today. Let’s break it down:

Invest, Don’t Just Earn

Making six figures doesn’t make you wealthy if taxes eat half your paycheck. The highest tax rates hit high earners the hardest. The goal isn’t just to earn more—it’s to own more. Invest in assets like index funds, real estate, or small businesses that grow over time.

Leverage Tax-Advantaged Accounts

Max out your 401(k), IRA, or HSA. These accounts allow your money to grow tax-free or tax-deferred, making your dollars work harder for you.

Get Professional Advice

The wealthy don’t guess—they hire experts. A tax advisor can uncover strategies that fit your unique situation and save you thousands every year. Don’t wing it when the stakes are high.

Building Wealth with Tax Strategies: What to Expect This Tax Season

- Tax Credit Updates

- The Earned Income Tax Credit (EITC) has increased for lower-income households. If you qualify, this credit can significantly reduce your tax burden or even lead to a refund.

- Standard Deduction Adjustments

- The IRS has increased the standard deduction for inflation. Single filers can claim $13,850, while married couples filing jointly can claim $27,700.

- Energy Efficiency Incentives

- Planning home upgrades? The Inflation Reduction Act offers tax credits for energy-efficient improvements like solar panels or HVAC systems. Check eligibility before starting any projects.

- Retirement Contributions

- Contribution limits for 401(k)s and IRAs have increased. Take advantage of these changes to maximize your tax-advantaged savings.

Building for Next Tax Season

Don’t just survive this tax season—start preparing for the next. Here’s how:

- Track Your Finances: Keep detailed records of expenses, investments, and income. Apps like QuickBooks or Mint can simplify the process.

- Plan for Deductions: Charitable donations, medical expenses, and education costs could save you big. Document everything to make filing easier.

- Stay Educated: Tax laws change frequently. Stay informed so you can adjust your strategies accordingly.

The Cost of Staying Ignorant

Here’s the harsh truth: If you don’t learn how to manage taxes strategically, you’ll pay more than you should. The tax code is designed to reward ownership, investment, and long-term planning. Every dollar overpaid in taxes is a dollar that could have been working for your future.

Don’t let taxes drain your wealth. Take control with the right strategies. Start by joining our Money Talk for actionable tips and expert insights that make your finances work for you, not against you.

Ready to start building wealth with tax strategies? Let’s have the conversation.

Need to elevate your credit for greater financial flexibility? Check out Credit Elevated—your free resource for managing and improving credit, a cornerstone of building wealth with tax strategies.

Leave a Reply