A Shift in Inflation – What the New CPI Report Means for Your Finances?

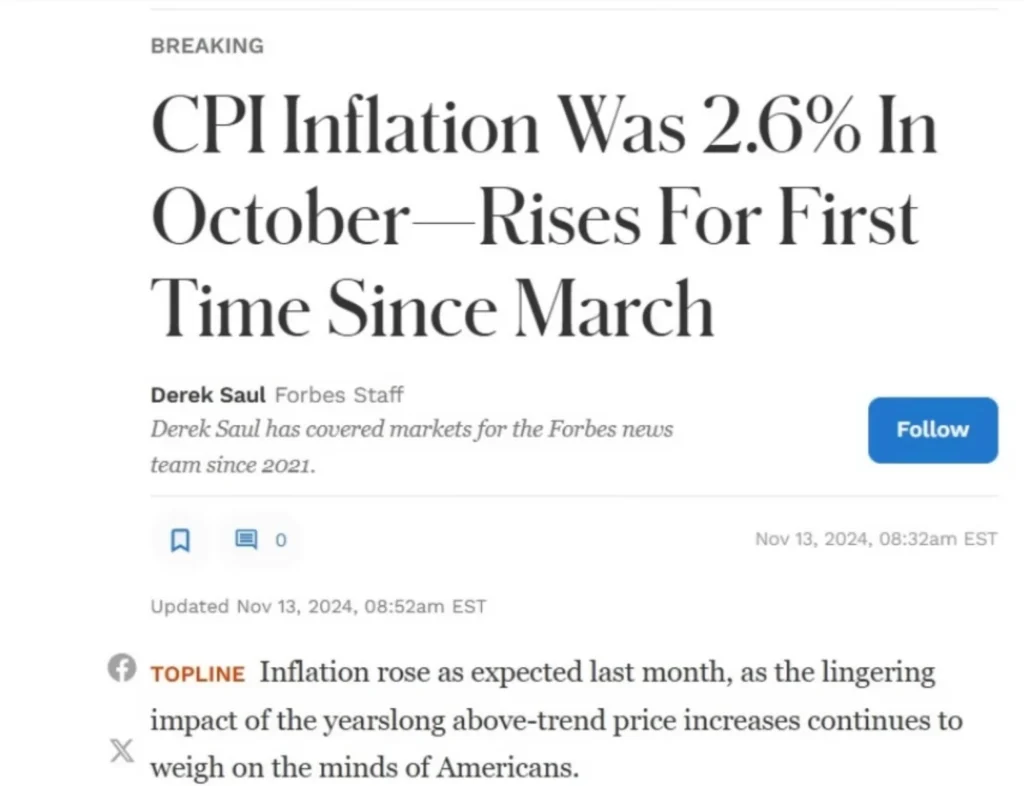

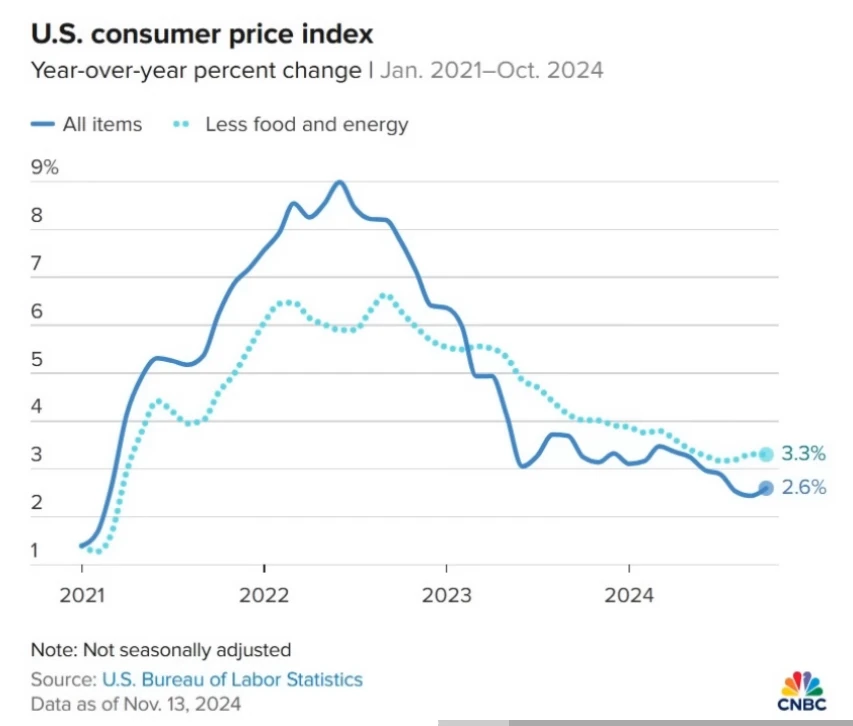

In today’s financial update, there’s breaking news that could impact your wallet. For the first time since March, inflation has ticked up, with headline inflation coming in at 2.6%, an increase from last month’s 2.4%. While core inflation held steady at 3.3%, the rise in headline inflation has stirred fresh debate.

(Quick Note: CPI, or Consumer Price Index, is a measure of the average change in prices over time for goods and services. It’s often used as a primary indicator of inflation, showing how much prices have increased or decreased from a previous period.)

With the Federal Reserve recently cutting interest rates in September, and inflation back on the rise, what does this all mean? Are we headed toward even higher inflation, or will the Fed take action to control it? In this post, we’ll break down the latest CPI report, dive into the Fed’s response, and explore what you can do to stay financially prepared.

The Federal Reserve’s Latest Moves on Interest Rates – What’s Happening Now?

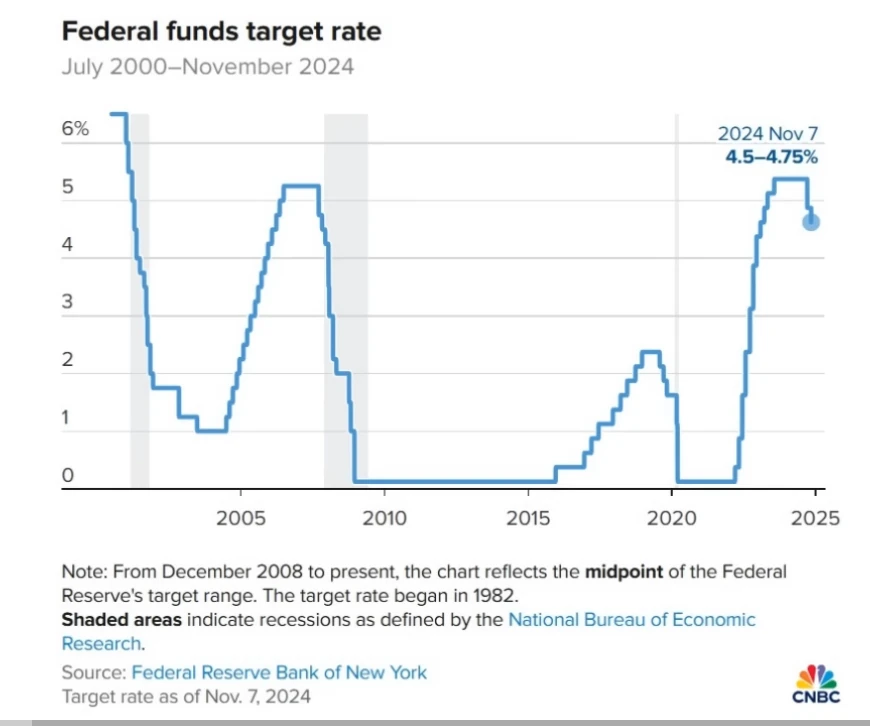

Just two months ago, on September 18th, the Federal Reserve announced its first interest rate cut in four years. With inflation now rising, it seems we might be on a path of “easy money” again, where low interest rates make borrowing cheaper and stimulate spending. This could also mean inflation risks returning, creating a challenging balancing act for the Fed.

“Here we go again. With inflation climbing, we’re left to wonder: Will the Fed keep cutting rates, or hit pause?”

On December 18th, the Fed will meet again to make another decision on interest rates. The question on everyone’s mind: Will they cut rates further, or hold steady to avoid fueling inflation?

Market Expectations – What Does the Data Say?

Using the CME Fed Watch Tool, we can gauge market odds for the Fed’s next move. (The CME Fed Watch Tool is a financial tool that tracks market expectations for changes in Federal Reserve interest rates. By analyzing futures contracts, it provides a forecast for the probability of rate hikes, cuts, or holds, based on current market sentiment.)Here’s what we’re seeing:

🔺 Before the CPI Report: A 60.3% chance that the Fed would cut rates by 0.25% at their December meeting.

🔺 After the CPI Report: The odds rose to 82.3%, signaling that the market believes inflation hasn’t spiked high enough to deter the Fed from making another cut.

This change shows the market’s confidence that the Fed will likely continue cutting rates despite inflation’s increase. The real question, however, is what the long-term impact of these cuts will be on inflation.

Inflation and Rate Cuts – What’s the Fed’s Endgame?

The Fed’s overarching goal is to bring inflation down to a steady 2%. But here’s the kicker: although they’ve cut rates recently, lowering rates generally leads to increased inflation over time. Let’s look at the current numbers and where the Fed stands:

- Headline Inflation: Up to 2.6% from last month’s 2.4%.

- Core Inflation: Unchanged at 3.3%.

These numbers reveal a dilemma. While the Fed targets a 2% inflation rate, recent cuts could add fuel to the inflationary fire. And though the Fed’s cuts since September may not yet have a noticeable effect, this “lag effect” means we could feel the full impact only by late 2025 or 2026.

A Historical Perspective on Inflation and Interest Rates

Historically, the Federal Reserve has raised interest rates significantly to curb inflation. Take a look at this trend from the 1950s onward. Whenever inflation got out of control, the Fed responded by hiking rates aggressively. This year, however, they’ve pivoted, lowering rates with a belief that inflation won’t overshoot their 2% target.

Chart Idea: Graph of Federal Reserve interest rate trends since the 1950s, with peaks during inflationary periods for visual context.

Investor Takeaways – How to Navigate Rising Inflation and Rate Cuts

So, what does all this mean for you? Whether you’re an investor, saver, or simply trying to stay ahead of inflation’s effects, here are some actionable insights:

- Timing Is Key

If the Fed continues to cut rates, we may see increased market activity and potential stock gains. For those invested in stocks, timing future investments can make a big difference. - Diversify Your Portfolio

To hedge against inflation, consider assets beyond traditional stocks and bonds, such as real estate or digital assets. Crypto can also be a hedge, though it comes with higher volatility. - Stay Informed on Policy Shifts

The Fed’s decisions affect everything from mortgage rates to credit card interest rates. Keeping an eye on their moves can help you plan and make informed financial decisions.

The Road Ahead – What’s Next for the Economy and Inflation?

Looking forward, we see a complex road ahead. The Fed may keep cutting rates to stimulate growth, but the “easy money” environment often brings with it a risk of accelerated inflation. While this CPI report’s bump might be minor, it could hint at what’s to come in 2025 and beyond.

With the Fed aiming for a soft landing on inflation, we may be entering a period where prices stabilize rather than fall, even as interest rates fluctuate. The next two years could bring a “re-acceleration” of inflation that gradually builds, with its full impact felt around 2026.

FAQ: Common Questions About Inflation and Rate Cuts

Q: Why does the Federal Reserve cut interest rates if it increases inflation?

A: Lower interest rates stimulate borrowing and spending, which can lead to economic growth. However, this also creates a demand-driven rise in prices, thus increasing inflation. The Fed often uses rate cuts as a temporary measure to support the economy.

Q: How do rising inflation and rate cuts affect my investments?

A: Rate cuts can increase asset prices, but inflation erodes purchasing power over time. This is why it’s essential to have a diversified portfolio that balances risk and hedges against inflation.

Q: What is the likelihood of continued rate cuts in 2025?

A: Based on current market expectations, the Fed may continue with a dovish approach to maintain economic stability. However, the Fed’s actions will largely depend on inflation trends and economic performance.

Staying Financially Prepared in an Evolving Economy

With inflation rising again and the Fed leaning toward lower rates, now is a crucial time to assess your financial strategy. Whether you’re concerned about mortgage rates, your investment portfolio, or just keeping up with everyday costs, staying informed is the best move.

Inflation’s rise and the Fed’s rate cuts signal an economy in flux—one where savvy planning and timely adjustments can make a difference. As we navigate this dynamic landscape, the most proactive investors are the ones who stay updated and adaptable.

Stay Ahead of the Game in Finance and Inflation Trends

For the latest insights, trends, and strategies in finance and inflation management, join our community. Subscribe to our blog for updates and catch our detailed breakdowns on our 👉 YouTube Channel for deeper dives into the topics shaping the economy today.

Leave a Reply