Series: Credit Elevated: Five Power Moves to Shatter Debt & Raise Scores

(Missed Post #3 on utilization? Catch it here and see how single-digit usage can supercharge your score.)

Time to Wrestle with Charge-Offs: Remove Charge-Offs Fast

Alright, we’ve squared away the “junk data” (Post #1), tackled late payments (Post #2), and learned how to leverage utilization (Post #3). Now it’s time to deal with charge-offs, arguably the biggest negative lurking in your credit file. If you want to remove charge-offs fast, I’ve got your back—no so-called “guru” secrets, just the advanced moves you need.

If you are looking for ways to remove charge-offs fast, implementing these strategies will help.

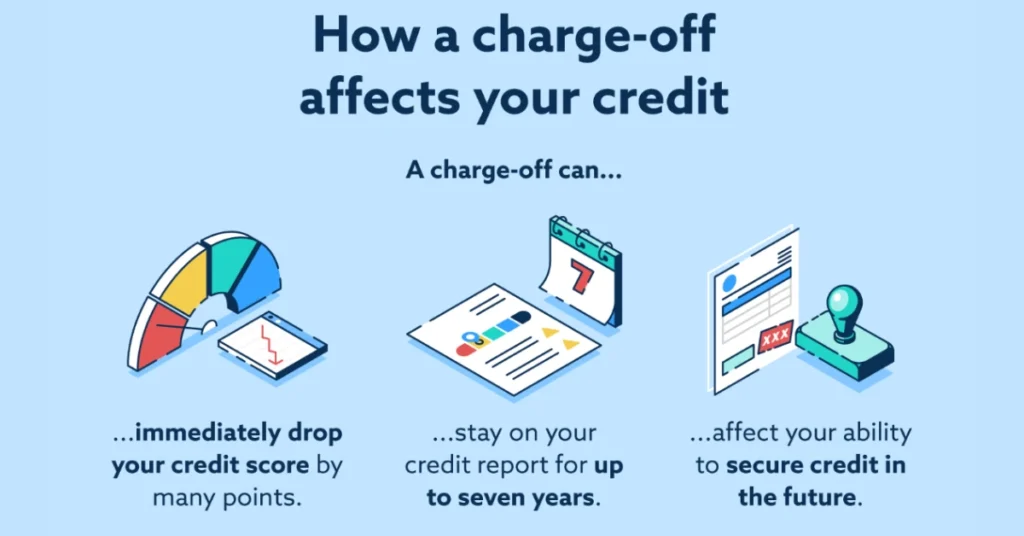

Why Charge-Offs Are So Harmful

Think of a charge-off like a giant flag on your credit report that screams “high risk.” Let’s break it down:

💎 A charge-off happens when a creditor writes off your unpaid debt as a loss, usually around 180 days of no payments.

💎 You can lose 80–100+ points (sometimes more) per charge-off, which can linger for up to 7 years.

💎 Even partial payoffs often won’t remove that “Charge-off” label—unless you do something about it.

The good news? Not all charge-offs are legit or properly documented. That’s your window.

Being proactive can help you remove charge-offs fast, rather than waiting for them to disappear on their own.

Ownership & Proof: The Advanced Dispute Tactic

Actively remove charge-offs fast and you can significantly improve your credit score and open up new financial opportunities.

Often, when your debt hits “charge-off” status, the original lender sells or transfers it to a collection agency. Sometimes they mess up the paperwork or skip steps.

With the right information, you can remove charge-offs fast and effectively take control of your credit health.

Here’s how to use that to your advantage:

- Original Agreement: Did you sign for that loan or credit line? Prove it.

- Chain of Title: If your debt was sold, can the new holder actually show legal ownership (receipts, purchase agreements)?

- No Double Reporting: Sometimes both the original lender and the collection agency report the same debt. That’s an error you can challenge.

📌 Demand legit proof of ownership. If they can’t provide it? Game over. That charge-off has no business being on your report.

(Heads up: This approach is wildly underrated but super strong for removing inaccuracies quickly.)

Disputes: More Than a Form Letter

A generic “I dispute this” letter usually won’t cut it for charge-offs. You need a factual dispute that highlights specific issues:

- Check All Account Details: The account number, balance, dates, or status.

- Look for Errors: Did they tack on extra fees, interest after the charge-off date, or misreport balances?

- Leverage Consumer Protection Laws: The Truth in Lending Act (TILA) and other regulations force lenders to follow certain steps if they transfer or close out an account.

- Send a Custom Letter: Outline each mistake or missing doc. If they can’t fix it, you want that charge-off removed entirely.

📌 Not a fan of writing or mailing disputes? A platform like creditelevated.pro automates these advanced steps, using Metro2 coding to challenge data directly at the bureaus.

Having a plan in place to remove charge-offs fast can reduce stress and uncertainty in your financial journey.

Settlement & Pay-to-Delete: Proceed Cautiously

Pay-to-delete or settling might feel like the quick fix, but there’s a catch:

💎 No Guarantee: Some lenders won’t remove the charge-off label even if you pay.

💎 Get It in Writing: If they promise to remove it once you pay, insist on a written agreement before handing over cash.

💎 Partial vs. Full Settlement: A partial payoff can still leave “settled for less” on your file, which is less negative—but still not squeaky clean.

📌 Go pay-to-delete only if you have black-and-white proof they’ll remove the “Charge-off” status once the check clears.

With determination, you can successfully remove charge-offs fast and enhance your credit score.

Concrete Steps to Remove Charge-Offs Fast

The key to remove charge-offs fast lies in persistent follow-ups and accurate documentation.

- Pull Your Reports

- Identify every charge-off, note the lender(s) and any collection agencies.

- Verify Ownership

- If they can’t prove they legally own the debt, it’s not valid—demand removal.

- Factual Dispute

- List out errors (dates, balances, fees). No guesswork—use real facts.

- Negotiate If Needed

- If the lender proves ownership, you can consider pay-to-delete. But get that removal promise in writing.

- Monitor Monthly

- Check your report every month. Once the charge-off disappears, expect a decent score bump.

Tie It Back to the Series

You’re at Post #4 in our Credit Elevated series:

📌 Post #1 – Cleared out “junk data.”

📌 Post #2 – Tackled late payments.

📌 Post #3 – Mastered credit utilization.

- Now – Charge-offs.

Up next, Post #5: Trended Data & The New Frontier—where we expand on building long-term credit success after clearing out the deck.

(Need a refresher on Post #3 about single-digit usage? Catch it here.)

Let’s explore some effective methods to remove charge-offs fast and improve your credit profile.

Next Steps

1.) Check All Charge-Offs: Are they accurate? Did you actually sign?

2.) Look for Inaccuracies: Many charge-offs are riddled with mistakes or misownership.

3.) Settlement?: Make sure it’s your final resort, and only with removal in writing.

4.) Stay Vigilant: Once the charge-off is gone, you’ll likely see a solid score boost.

Remember: Charge-offs might sound scary, but they’re beatable. A well-built dispute—backed by proof-of-ownership checks and TILA compliance—can remove charge-offs fast. Don’t sit back and accept a 100+ point drop. Go reclaim your score.

Stay tuned for Post #5: Trended Data & the New Frontier. Because after you’ve cleared these negatives, it’s time to build your future credit momentum with confidence.

(Disclaimer: This post is for informational purposes and not legal or financial advice. Always consult a qualified professional for your personal credit needs.)

Understanding your rights can help you remove charge-offs fast without unnecessary complications.

Leave a Reply