Consistency in financial growth isn’t built overnight—it’s crafted through daily, intentional actions.

In finance, slow and steady doesn’t just win the race—it creates wealth.

We all want financial freedom, but here’s the truth: It doesn’t happen with one big break or a lucky lottery ticket. True financial success is a marathon, not a sprint. And like any marathon, it’s your daily pace that determines whether you reach the finish line.

Consistency in financial growth isn’t glamorous, but it’s the secret sauce to building wealth that lasts. Too often, people chase quick fixes, thinking there’s a hack to bypass hard work. But the real hack? Showing up every single day and sticking to a plan. Let’s break it down.

Why Consistency in Financial Growth Matters?

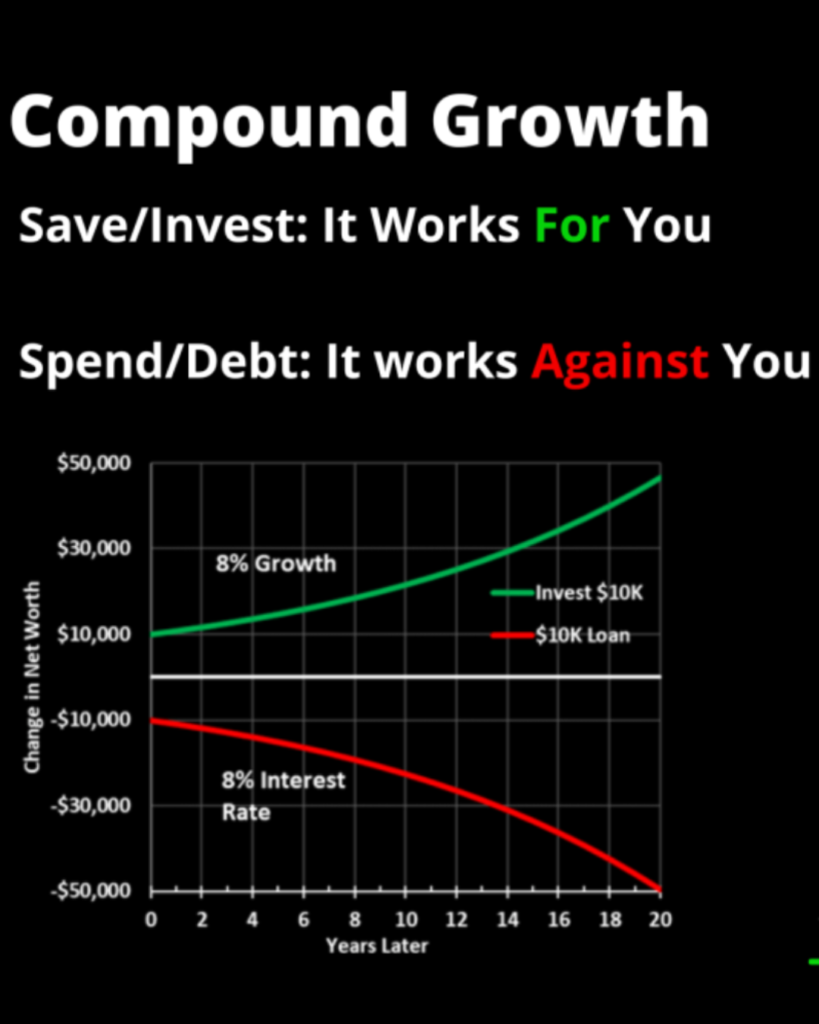

Financial growth thrives on the compounding effect—small, steady actions that build momentum over time. Saving just $10 a day adds up to $3,650 a year, and when invested wisely, it can grow exponentially, turning small efforts into big results.

Example: Imagine starting with $50 a month in an index fund. At a modest 8% annual return, that grows to over $15,000 in 10 years—and over $75,000 in 30 years. The magic isn’t in huge, flashy deposits. It’s in sticking to the habit month after month, year after year.

Consistency also builds confidence. Every small win—whether it’s sticking to a budget, making a loan payment, or setting aside an investment—gives you proof that you’re moving in the right direction.

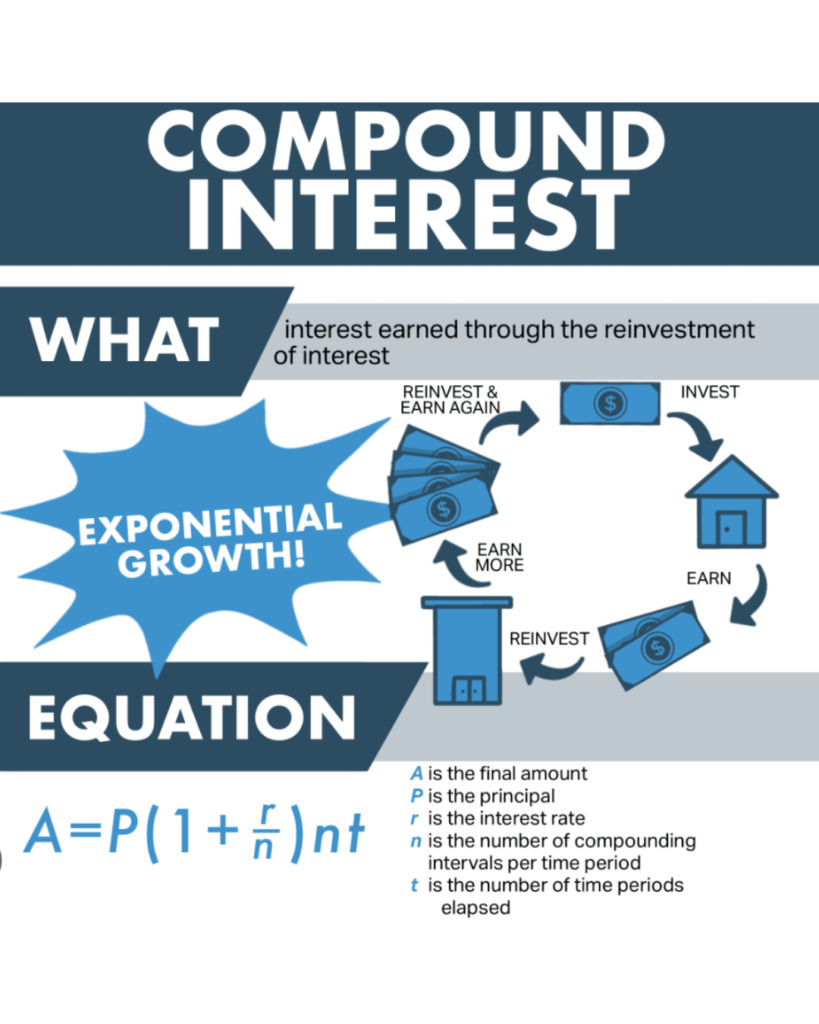

Compound interest cycle showing how consistency in financial growth through reinvesting earnings leads to exponential financial growth.

Daily Habits for Financial Success

Big goals are great, but they’re built on the back of small, repeatable habits. Here are a few to incorporate into your routine:

- Budgeting Start with a simple plan: Know what’s coming in and going out. Apps like YNAB or Mint make it easy to track and adjust your spending.

- Tracking Expenses Commit to tracking every dollar. It’s not about judgment; it’s about awareness. The clearer the picture, the better decisions you can make.

- Incremental Investing Use tools like Acorns or Robinhood to start small. Even rounding up spare change into an investment account can have a significant impact over time.

- Automated Savings Set up automatic transfers to your savings or investment accounts. When it’s out of sight, it’s out of temptation—and it grows quietly in the background.

- Debt Payments Make it a habit to pay more than the minimum on loans or credit cards. Consistently chipping away at debt reduces interest and frees up money for future growth.

By prioritizing consistency in financial growth, even small actions can lead to exponential results.

Overcoming Obstacles

Staying consistent sounds great in theory, but we all face hurdles. Here’s how to push through the common challenges:

- Procrastination Break tasks into bite-sized chunks. Instead of “Save $1,000,” think, “Save $5 today.” Small actions feel doable and build momentum.

- Burnout Pace yourself. Financial growth is a long game, so don’t overcommit or set unrealistic goals. Celebrate small wins to stay motivated.

- Distractions Create systems to keep you on track. Use reminders, set financial goals on your phone, or find an accountability partner to check in with regularly.

Pro Tip: Automate as much as possible. When savings, investments, or bill payments happen automatically, you eliminate decision fatigue and reduce the risk of falling off track.

Consistency isn’t just a strategy; it’s a mindset. Every small step you take today compounds into something bigger tomorrow. Whether it’s saving a few dollars, paying down debt, or learning about investments, the key is to start and stick with it.

So, what small step will you start today? Let us know and join the conversation at Money Talk to gain the tools and confidence to grow your wealth.

And don’t forget to explore Credit Elevated for expert tools and resources to manage and elevate your credit—the cornerstone of financial growth.

Leave a Reply