Crypto Taxes 2024: The IRS Wants Their Cut—Don’t Let Them Take More.

You’re stacking gains, but are you prepped for tax season?

The IRS is locking in on crypto. Slip up, and you’re not just paying taxes—you’re giving away more than you should.

Here’s the game plan: keep what’s yours, stay compliant, and dodge those costly mistakes.

I’ll break it down so you don’t overpay, underreport, or end up with a letter you’ll regret seeing.

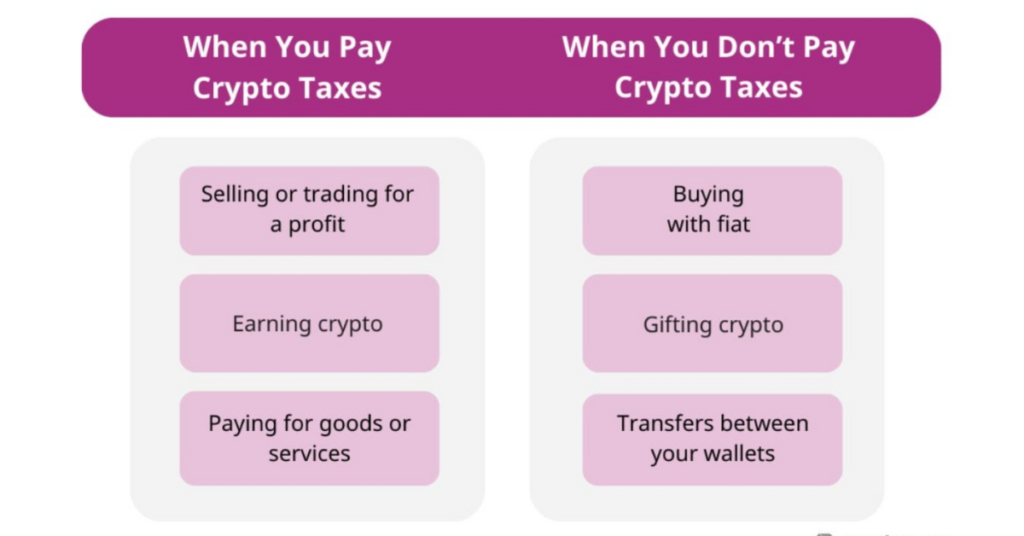

What Counts as a Taxable Event?

Not every crypto move you make is taxable. But when it is, you need to know.

These are the big ones:

💎 Selling crypto for cash: If you cashed out Bitcoin for dollars, any profit you made is taxable.

💎 Trading one crypto for another: Swapped Ethereum for Solana? Yep, that counts too.

💎 Spending crypto on goods or services: Even buying a pizza with Bitcoin creates a taxable event.

💎 Earning crypto as income: Got paid in crypto? That’s income, and the IRS wants their cut.

Now, here’s what doesn’t trigger taxes:

💎 Buying crypto with cash: If you’re just holding it, you’re good—for now.

💎 Transferring crypto between wallets: Moving coins around? No taxes here.

Don’t Trust Your 1099 Blindly

When your exchange sends you a 1099, it’s tempting to assume the numbers are right. Don’t. These forms are often incomplete or wrong. The most common mistake? Leaving out your cost basis (what you paid for your crypto).

Let me break it down:

If you sold Bitcoin for $10,000 but bought it for $5,000, your taxable gain is $5,000. But if your 1099 only shows the $10,000 sale without the $5,000 purchase, the IRS will think you made a $10,000 profit—and you’ll end up overpaying your taxes.

What to do:

Cross-check everything. Your transaction history is your safety net. Make sure your tax return reflects the actual gains, not what your 1099 assumes.

How to Handle Crypto Taxes Without Losing Sleep

- Track Everything

Keep a record of every trade, purchase, and sale. Use a crypto tracking tool or a simple spreadsheet—it doesn’t matter how, as long as it’s accurate. - Plan for Taxes

Set aside a percentage of your profits. If you’re unsure, 20–30% is a good starting point. Better to have extra than to come up short. - Know Your Rates

- Short-term gains (held for 1 year or less) are taxed as ordinary income—up to 40.8%.

- Long-term gains (held for over 1 year) get lower rates—up to 23.8%.

- Ask for Help if You Need It

Crypto taxes can get messy, especially if you’re dealing with multiple exchanges. Don’t hesitate to bring in a pro if you’re overwhelmed.

Learn From Others’ Mistakes

Here’s a real story for you: A trader made $300,000 in crypto profits one year but didn’t set aside money for taxes. The market tanked, and he lost everything—including the cash he needed for his tax bill.

The IRS doesn’t care if your portfolio crashes. They’ll still come knocking for their cut of last year’s gains. Don’t let this happen to you.

Crypto Taxes 2024 Don’t Have to Be a Headache

If you stay informed and prepared, you can avoid surprises, save money, and keep the IRS off your back.

This isn’t about gaming the system—it’s about knowing the rules so you can play smarter.

What’s your next move?

Are you setting aside for taxes, or are there questions you still need answered? Let’s talk in the comments.

Further Reading: Deepen Your Financial Knowledge

📌 Foundations of Financial Literacy: Smarter Money Management

Get actionable insights to build financial stability and grow your wealth step by step.

Read more

📌 IRS Digital Assets Guidelines

The official IRS guide on digital assets and tax compliance. A critical resource for understanding tax obligations for crypto transactions.

Visit IRS Digital Assets Guidelines

📌 The Health-Wealth Connection: Proven Ways to Build Financial Security

Explore how your health directly impacts your financial well-being and long-term success.

Read more

Empowering you with the tools to master your finances—one step at a time.

Leave a Reply