What if the price of your everyday essentials skyrocketed overnight—just to protect ‘American jobs’?

The truth isn’t as simple as it seems—let’s unpack it.

Trump’s Tariff Plan: What’s Really at Stake?

Trump’s tariff plan is back in the spotlight, and whether you’ve heard about it over your morning coffee or during a debate on the job, one thing is certain: this isn’t just a story for the news—it’s about your wallet, your family, and the costs that ripple through your everyday life.

Breaking Down Trump’s Tariff Plan

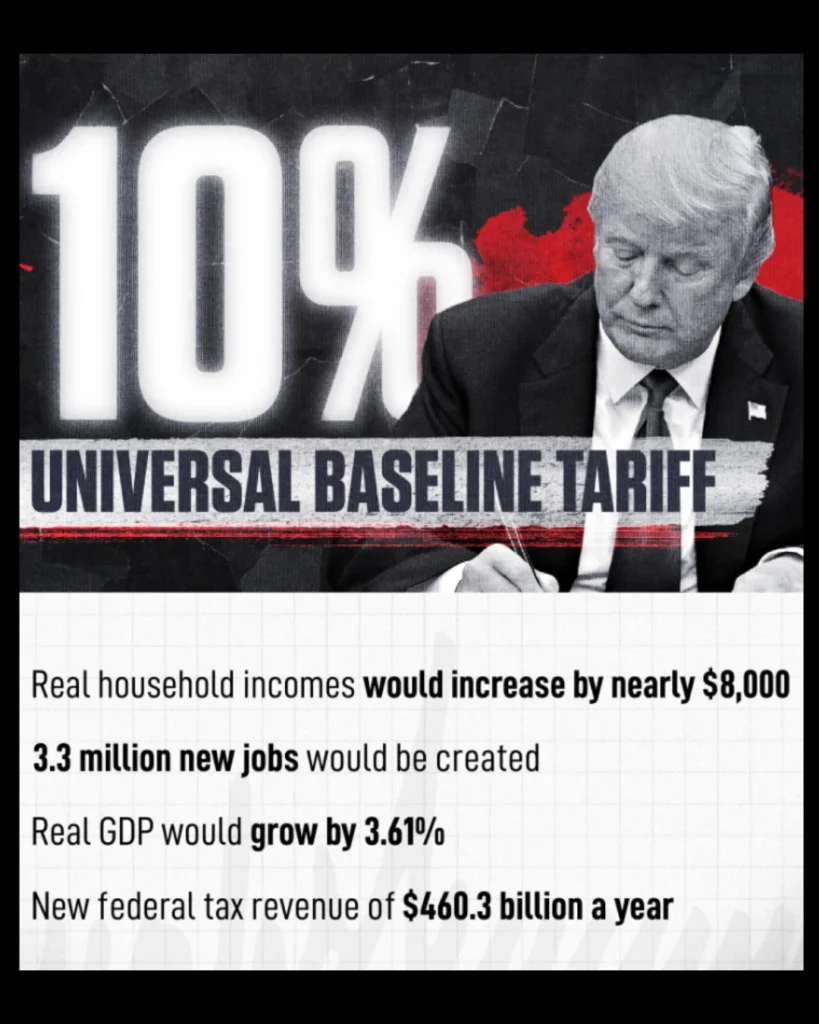

In simple terms, Trump’s tariff plan proposes a 10% universal tax on all imported goods, with a much steeper tariff (up to 100%) targeting goods from China. That means everything from the groceries in your cart to the electronics you depend on could see a price hike.

Why tariffs? Supporters say they’ll bring jobs back home, boost American manufacturing, and generate revenue for the government. Critics argue they’re just another tax disguised as policy, one that could lead to higher prices, strained trade relationships, and inflation.

But what does all this mean for you?

The Real-Life Impact of Trump’s Tariff Plan

Let’s keep it real. For the average working person, especially in working-class communities, tariffs often hit hardest at the checkout line. Here’s how:

1. Grocery Prices

Imagine your favorite produce—say, those oranges from Mexico or bananas from Costa Rica—suddenly costing 10% more. Farmers who rely on imported equipment will also see price increases, which trickle down to the prices you pay for fresh goods.

2. Clothing and Electronics

That phone upgrade you’ve been eyeing? Or those sneakers your kids need for school? With tariffs targeting countries where these goods are made cheaply, prices could jump, leaving fewer dollars in your pocket for other essentials.

3. Fuel Costs

Even energy production isn’t immune. With tariffs on imported oil and refining materials, gas prices could creep higher, further squeezing your budget.

A Historical Perspective: How Tariffs Have Played Out Before

This isn’t the first time the U.S. has leaned on tariffs as an economic tool. A century ago, tariffs were a primary source of government revenue. But here’s the catch: back then, the federal government was much smaller, spending just 2.7% of GDP. Today, it spends nearly 25%. Even if Trump’s tariff plan raises an estimated $400 billion annually, it won’t come close to closing the gap.

What’s more, previous tariffs, like those on steel and aluminum, haven’t always delivered the promised benefits. While they protected some industries, others faced higher costs, job losses, and strained trade relationships.

What About Retaliation?

Here’s where it gets even more complicated. Tariffs don’t just impact us—they provoke responses. Countries like China could retaliate by imposing their own taxes on U.S. goods. That’s not just a blow to corporations; it’s a direct hit to farmers, manufacturers, and workers who rely on exports to keep their businesses afloat.

Do the Benefits Outweigh the Costs?

This is the big question. While Trump’s tariff plan could create jobs and generate revenue, the potential downsides are just as significant: higher consumer costs, inflation, and strained global trade.

Here’s the truth: whether the benefits outweigh the costs depends on who you ask. For big businesses, the plan might offer a strategic edge. For the average American, especially those already feeling the pinch, it’s another cost to bear in an already challenging economy.

Let’s Make It Personal

At the end of the day, policies like Trump’s tariff plan aren’t just about economics—they’re about priorities. Who wins? Who loses? And what happens when the everyday person is caught in the middle?

If this conversation matters to you—and it should—then it’s time to stay informed. Tariffs may feel like a distant policy, but their effects land close to home. Groceries. Gas. School supplies. It all connects back to these policies.

Ready to navigate these economic shifts with confidence? At Skyline Pivot, we break down complex topics like Trump’s tariff plan to help you take charge of your financial future. Stay informed, stay ahead with our Money Talks.

Further Reading

Understanding Tariffs: Learn the basics of how tariffs work and their impact on the economy. Read here

Trump threatens 100% tariff on the BRIC bloc of nations if they act to undermine US dollar

- President Donald Trump has issued a bold warning to the BRIC bloc (Brazil, Russia, India, China, and South Africa), threatening a 100% tariff on imports from these nations if they take actions to weaken the dominance of the U.S. dollar in global trade.

Leave a Reply