In this Housing Market Update 2025, we delve into the challenging realities and shocking predictions shaping the housing market. From rising home prices to fluctuating mortgage rates, this year’s trends reveal a complex yet fascinating story for buyers and sellers alike.

Have you been holding your breath, waiting for a housing market crash? Or maybe you’re just wondering if 2025 will finally be the year things stabilize. Let’s talk about it—the numbers, the trends, and what it all means for you. No jargon, just real talk about the housing market update 2025.

Waiting for a housing market crash? Here’s what the data really says about 2025.

Spoiler: It’s not the crash you’ve been waiting for, but there’s more to the story.

What’s the Real Story Behind Housing Market Trends?

The Housing Market Update 2025 reveals critical trends in both rising and cooling markets. If you’ve been scrolling through headlines or watching clickbait videos, you’ve probably heard predictions of a market crash every year since 2021. And yet, here we are—median home prices are up 5.1% compared to last year.

It’s frustrating, I get it. But let’s unpack what’s really happening.

Why No Crash? Let’s Break It Down

Inventory Levels Tell the Story

In 2025, the U.S. housing market has about 1.8 million homes available for sale. To put that into perspective, a “normal” market needs around 2.25 million homes. Less supply means prices stay steady or climb—basic economics.

Delinquencies Are Low

Remember 2008? Mortgage delinquencies skyrocketed, leading to mass foreclosures. Today? Delinquency rates (loans 90+ days overdue) are at historic lows. People are stretched, but they’re still paying their mortgages.

The Local Perspective: Is It Just a Florida Thing?

You’ve probably heard, “Florida’s market is crashing!” Well, here’s the data:

- Tampa: Home prices dipped 0.4% compared to last year—not exactly a crash.

- Miami: Prices are up 2.3%, showing steady growth.

National trends matter, but so do local markets. Florida isn’t the outlier some claim it to be.

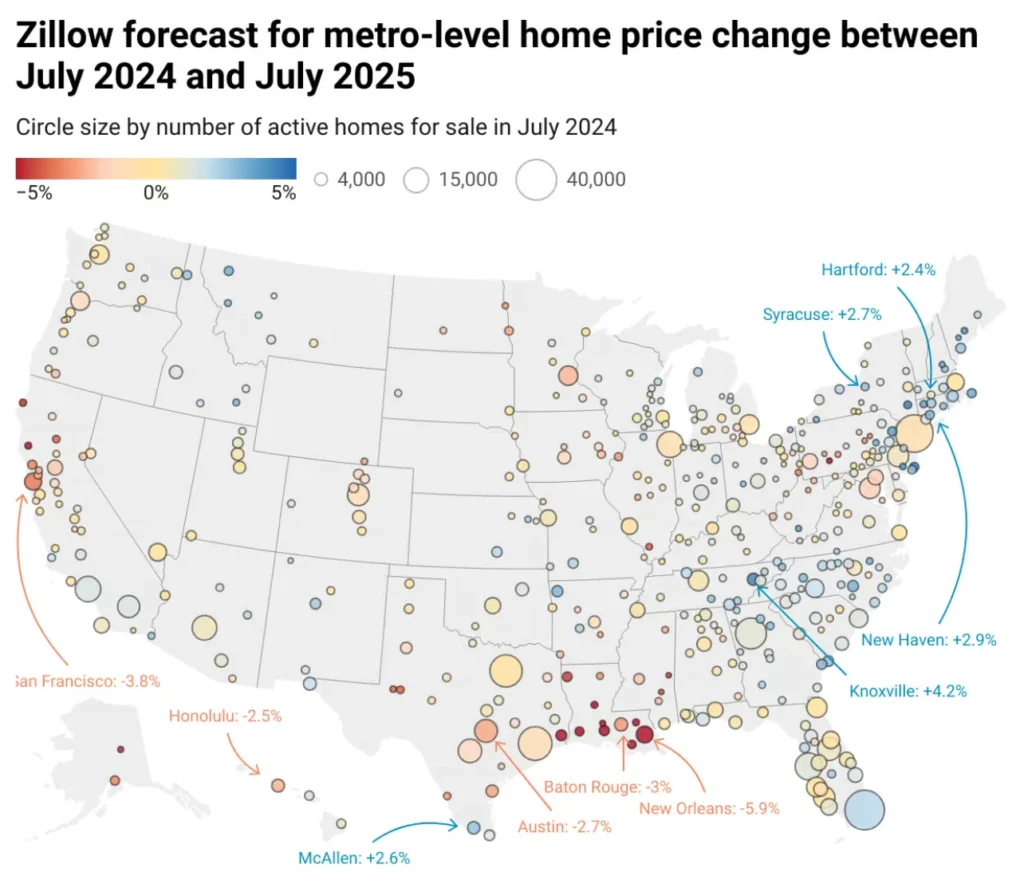

The Bigger Picture: What’s Happening Nationally?

Across the U.S., hot markets like San Francisco and Los Angeles are seeing small recoveries:

- San Francisco: Down 10% from peak but climbing back, with a 1.4% increase last year.

- Los Angeles: Near record highs, up 4.6%.

- New York City: Leading with a 7% rise in 2025.

What does this mean? The long-term trend in home prices has always been upward. Even in a bubble, prices don’t necessarily crash—they might just grow more slowly.

A Quick Story to Put Things in Perspective

I have two friends who bought homes in Austin, TX:

- Friend 1: Bought at the market’s peak in 2007. His home value is up $500,000 today.

- Friend 2: Bought at rock-bottom prices in 2010. His home value is up $550,000.

What’s the lesson? Timing matters less in the long run. Over time, home values tend to rise.

Mortgage Rates: Where Are We Now?

According to this year’s Housing Market Update 2025, mortgage rates are predicted to stabilize, though affordability remains a challenge. Let’s talk interest rates. The 30-year fixed mortgage is hovering around 6.84%, close to 7%. Rates might feel high, but they’re expected to stabilize as the Federal Reserve eases monetary policy. It’s a slow process, but patience pays off.

Housing Market Update 2025: What the Experts Predict

Here’s what institutions are forecasting:

- Goldman Sachs: Predicts a 4.4% rise in home prices.

- Moody’s: A modest 0.3% increase.

- Average Forecast: 2.6% growth in 2025.

No crash, just steady growth.

What Should You Do?

If you’re waiting for a crash to buy a home, consider this:

- Supply and Demand: With low inventory, prices aren’t likely to drop significantly.

- Long-Term Investment: Real estate tends to appreciate over time.

- Educate Yourself: Stay informed about local markets and trends.

Want to Dive Deeper?

Here are some trusted resources to help you make informed decisions:

For more insights, check out our Wealth Foundations section for tips on navigating the housing market.

Your Take

What’s your outlook for 2025? Do you think a crash is still coming, or are we in for more steady growth? Drop your thoughts below, and let’s keep this conversation going.

Curious about how the latest Housing Market Update 2025 could shape your financial journey? At Money Talk, we don’t just talk numbers—we break them down into real-world insights that help you take action. Whether you’re buying, selling, or just staying informed, understanding the housing market is key to making smarter financial moves.

Join the conversation at Money Talk, where we simplify complex topics like home prices, mortgage trends, and future predictions. Stay ahead of the curve with actionable insights tailored for you.

Leave a Reply