Oil Prices 2025 aren’t just a headline—it’s about to get serious.

If you’re watching gas prices jump overnight and wondering what’s really going on, this one’s for you.

It’s bigger than the pump. Right now, global tension in the Middle East is putting pressure on oil prices, which in turn could stall interest rate cuts and throw inflation right back into your day-to-day life. If you thought $3.13 a gallon was bad, try picturing $7. Welcome to a financial chain reaction that’s already in motion.

Let’s get into it.

What’s Behind the Spike in Oil Prices 2025?

This isn’t just about supply and demand. This is geopolitical pressure turned economic heat.

The ongoing military exchange between Israel and Iran has the global energy market spooked. Israel’s recent strikes, including the bombing of Iranian oil depots and military sites, triggered retaliatory missile and drone attacks. The fear? That it won’t stop there.

Although Iran’s oil exports haven’t been materially affected yet, the fear of further escalation is enough to send crude oil prices soaring. We’re not talking speculation. We’re talking $60 a barrel rising fast.

Why the Strait of Hormuz Matters in 2025

Look at the map, and there it is: the Strait of Hormuz. The most critical choke point for oil in the world.

Over 12 to 20 million barrels of oil pass through this narrow lane every single day. If Iran even attempts to block or disrupt that flow, oil prices could explode. Sure, the U.S. Navy has a presence in the area. But attacks don’t have to be full blockades—they could be mines, missile strikes, or piracy, all of which are disruptive enough to spook markets.

We’ve seen it before. In 2019, four commercial ships, including oil tankers, were hit. The same playbook could resurface.

Gas Prices in the U.S.: What to Expect in the Oil Prices 2025 Era

Gas is already creeping up. The national average sits at $3.13 per gallon. California? $4.65 and climbing. GasBuddy’s experts predict a jump of 10 to 25 cents per gallon soon.

But if oil hits $120 a barrel again—which JP Morgan says is possible under continued escalation—you’re looking at $5 national average gas. And in some California spots? $7+.

This isn’t panic—it’s pattern recognition. And the patterns are pointing straight at your wallet.

Inflation and Interest Rates: The Domino Effect

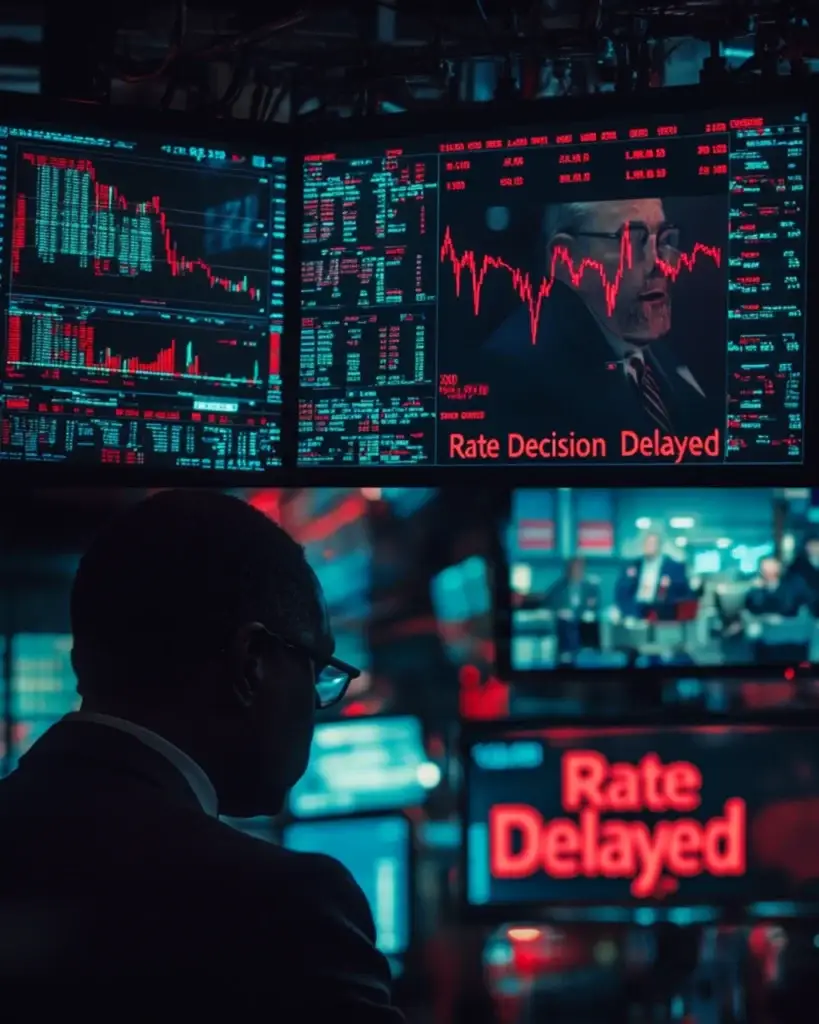

Falling oil prices had been holding inflation in check. That kept the Fed calm, even teasing potential interest rate cuts. But if oil rises again, so does inflation—and the Fed will be forced to hit pause on those rate cuts.

Right now, the FedWatch Tool projects a 96.7% chance of no rate cut in June, and an 80.7% chance of no rate cut in July. Cuts might come in September… unless oil prices derail that too.

That means higher credit card APRs, tighter mortgage lending, and slower business loans. And yes—it means your money doesn’t go as far.

Politics at Play: Trump, Putin, and the Bigger Game

Publicly, Trump is calling for peace. Privately? He’s on record saying “sometimes they just gotta fight it out.” And behind the curtain, analysts speculate: If Iranian energy is cut off, China gets squeezed (as their biggest importer), and Russia stands to gain. Putin and Trump both spoke last weekend. Coincidence?

Higher oil prices might be politically inconvenient at home but advantageous elsewhere.

What Can You Do Right Now?

This isn’t just global politics. It’s personal finance strategy in real time.

- Lock in stability: If your utility provider offers a fixed-rate contract, take it.

- Plan for higher gas: Budget like prices will climb.

- Prioritize debt reduction: Rising rates = more expensive borrowing.

Let’s Bring This Home on Oil Prices 2025

When oil prices shift, so does everything: transportation costs, groceries, housing interest, inflation, and credit access. This is one of those moments where doing nothing can cost you.

📌 Want to stay ready, not reactive? Keep tabs on insights like these inside our Money Talk hub.

📌 And if your credit needs work before borrowing costs rise, now’s the time to take action. Visit CreditElevated.pro—disputes are free and just a click away.

Stay sharp, stay aware. Skyline Pivot’s got you.

Leave a Reply